Your contribution no matter how big or small has an impact.

Thank you for your interest in supporting Beyond Blue through workplace giving.

Workplace giving

"Support Beyond Blue through workplace giving and help save lives"

Start payroll givingIframe content loading...

Our team members chose Beyond Blue as one of their nominated charities in recognition that anxiety and depression are significant issues within our community, and this was an area they want to make a difference to and actively support."

Robyn Batson, Sussan Group

_______

Business donations and fundraising

To make a business donation (this does not include company matching for payroll giving) please use our online donor form or contact donations@beyondblue.org.au. Alternatively, if you're interested in fundraising for us, find more information on our fundraising website.

Individual employees

If you are an employee wondering how you can sign up or get your workplace on board, we recommend speaking to your HR or Payroll team. If your organisation does not already have a program set up, you can refer them to the information provided above.

Your impact

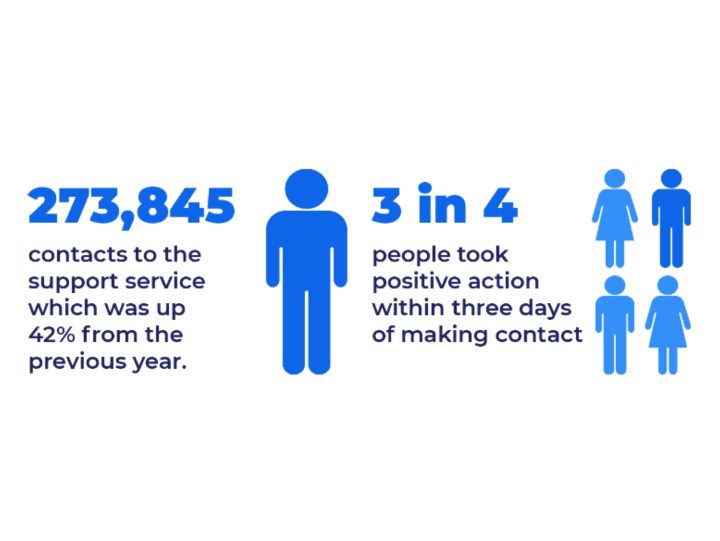

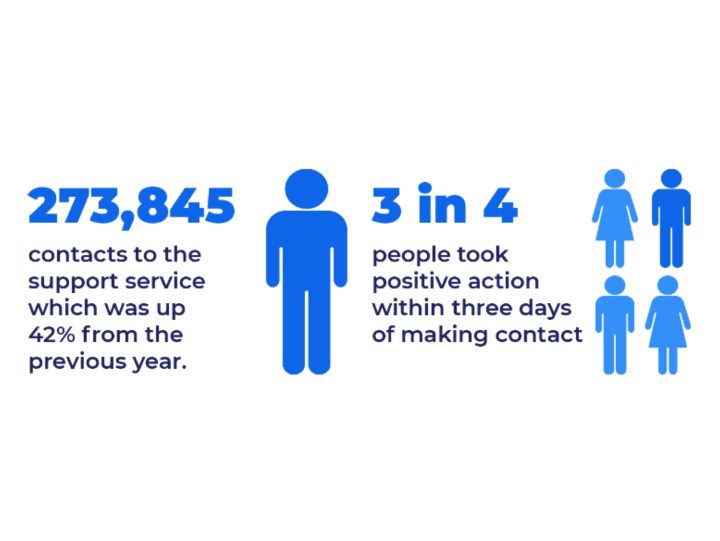

Every month, thousands of people reach out to Beyond Blue for advice, support and information. Your donations go directly towards funding our Support Service so these calls don’t go unanswered.

In the 2019-20 financial year, 273,845 people contacted our Support Service.

By supporting Beyond Blue, you are joining a community that is working to reduce the stigma, prejudice and discrimination that act as barriers to people reaching out for support.

Thank you for being part of our community.

In the 2019-20 financial year, 273,845 people contacted our Support Service.

By supporting Beyond Blue, you are joining a community that is working to reduce the stigma, prejudice and discrimination that act as barriers to people reaching out for support.

Thank you for being part of our community.

Since 2015, Qantas has been proud to work with Beyond Blue to reduce the stigma and bias around mental illness through the sharing of Beyond Blue learning opportunities and resources to our employees and customers.

Qantas

_______

Beyond Blue is registered as a charity with the Australian Charities and Not-for-profits Commission (ACNC). Eligible tax-deductible donations have Deductible Gift Recipient (DGR) status with the Australian Tax Office.

"I felt like I’d been believed for the first time... it was really refreshing to have that support from someone, especially an actual professional.

It was nice to finally feel like I wasn’t alone."

- Rachael, Beyond Blue Speaker

When people feel all alone this Christmas, your kindness today means Beyond Blue counsellors will be there 24/7, to listen and support when it matters most.